Turning your hobby or passion into a full-time career is now easier than ever. Whether it’s sharing music with thousands online or teaching cooking classes from your kitchen, the internet has made almost anything possible. And for some, it really pays off—literally.

Like this parent, who shared that their 17-year-old son is making some serious cash from live streaming. We’re talking $3,000 a month! Impressive, right? But now, the parent thinks it’s time for their son to learn about money management and responsibility—by paying $600 in rent. The problem? Their spouse completely disagrees and wants their kid to enjoy his youth while he still can. The debate is on, and opinions are flying. Keep reading to see what people think!

Live streaming has turned into a profitable career, with even teenagers making impressive earnings

Image credits: charnsitr (not the actual photo)

A parent shared that their 17-year-old son is earning a significant amount of money through live streaming, and they now expect him to contribute by paying rent

Image credits: LightFieldStudios (not the actual photo)

Image credits: eunixradjaiq

Teaching kids about financial independence at a young age can be incredibly beneficial for their future

Parents usually want to do what’s best for their child’s future. They want them to grow into responsible, financially independent adults who can manage their money wisely. But sometimes, it’s tricky to find the balance between letting them enjoy their youth and teaching them about real-world responsibilities. When a child starts earning at a young age, the big question arises—should they contribute financially at home, or should they be allowed to enjoy their hard-earned money without pressure?

In order to gain deeper insights into this, Bored Panda spoke with Khushboo Dugar, a seasoned professional from India. A chartered accountant with expertise in financial planning and tax advisory, and a mother of two, she understands both the financial and emotional aspects of raising kids in a world where they can start earning at an early age. She shared her thoughts on how parents can introduce financial responsibility without taking away a child’s sense of freedom.

She begins by saying, “I strongly believe it’s important to start young when it comes to teaching kids about financial responsibility. The earlier they understand how to manage money, the better prepared they’ll be when they step into adulthood. Many parents wait until their kids are older, but small habits formed early can have a huge impact later.”

“Take small steps,” she advises. “Kids learn better when they are young. Instead of overwhelming them with complex financial lessons, parents can start with simple concepts like saving, budgeting, and understanding the value of money. Even giving them small financial responsibilities, like handling a set amount of pocket money or saving up for something they want, can be a great lesson.”

“Especially today, when age is just a number and kids as young as 10 are earning through social media, it’s even more important to introduce them to financial literacy early on,” she explains. “The opportunities for young creators and entrepreneurs are endless, but if they don’t learn how to handle their earnings wisely, they might struggle with financial management later in life.”

Image credits: StudioPeace (not the actual photo)

There’s a fine line between guiding kids toward financial responsibility and placing too much pressure on them too soon

“It’s important for parents to teach their kids how to manage money, especially when they start earning early,” she says. “But before anything, parents should first discuss the approach they want to take. Some families may choose to charge a small rent, while others might focus on helping their child save or invest. Whatever the approach, it’s essential that both parents are on the same page to avoid unnecessary conflicts.”

“Without proper guidance, kids might use their earnings irresponsibly,” she points out. “Suddenly having access to a steady income at a young age can lead to overspending on unnecessary things instead of learning to save or invest. This is where parents can step in—not to control their money, but to help them make smart financial decisions that will benefit them in the long run.”

“One great way to guide them is to help them save for something meaningful,” she suggests. “Instead of forcing them to pay rent, parents could encourage them to set aside money for their dream college, a professional course, or even their first car. This teaches them the importance of saving while still allowing them to enjoy their earnings.”

“At the same time, you need to remember they are just kids,” she adds. “It’s important not to be too harsh on them. Instead of asking for a big amount for rent, parents can start small—maybe some money towards electricity or groceries. This way, they get the idea of contributing without feeling like they’re losing all their hard-earned money. The goal isn’t to make them feel burdened but to help them understand financial responsibility in a realistic and gradual way.”

“It all comes down to balance,” she concludes. “Parents should aim to support their child’s success while also preparing them for the real world. Instead of making them feel like they’re being punished for earning, it should be an opportunity to teach valuable financial lessons in a way that is fair and motivating for them.”

In this particular case, the parents were in disagreement about whether their son should pay rent. While introducing financial responsibility is important, the amount did seem a little high for a 17-year-old. What do you think? Should young earners contribute to household expenses, or should they be allowed to enjoy their earnings stress-free while they still can?

Image credits: Prostock-studio (not the actual photo)

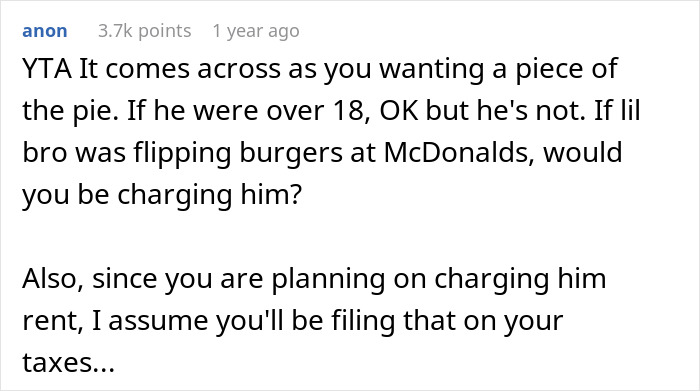

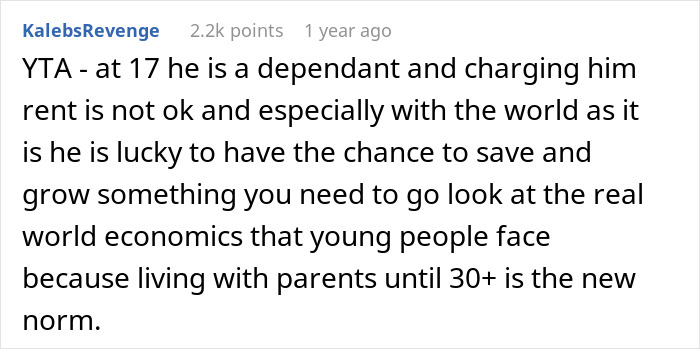

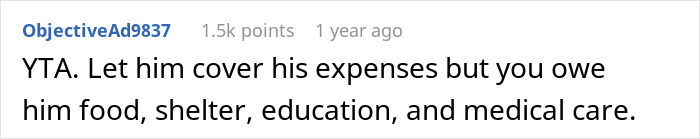

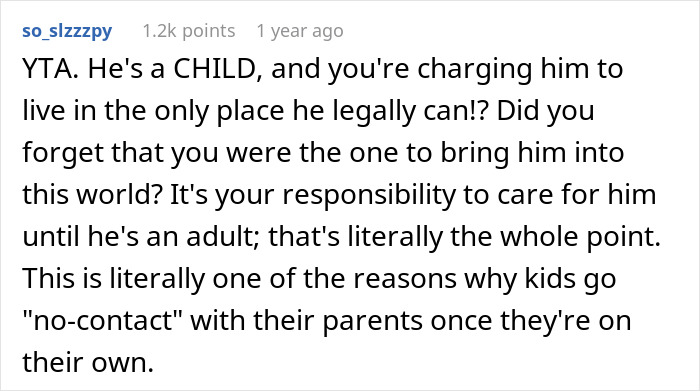

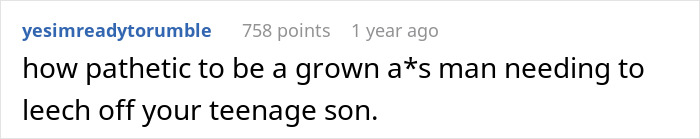

Many people online felt the parent was being too harsh for charging their son $600 in rent at such a young age

The post Woman Thinks It’s Appropriate To Charge 17YO Son $600 Rent Because He Earns A Lot first appeared on Bored Panda.

from Bored Panda https://ift.tt/dFUxHQV

via IFTTT source site : boredpanda