Today, everything from a movie ticket to college tuition is more expensive than it was a couple of decades ago. And the wages aren’t rising as fast as the prices.

Freddie Smith, a realtor from Orlando, Florida, says this is exceptionally visible in the housing sector.

Earlier this month, Smith released a TikTok video, where he breaks down the math of why Millennials have a harder time buying a home than Baby Boomers did.

The numbers look pretty grim, and the worst part is that you can’t really argue about them.

Image credits: fmsmith319

“Any time a millennial is trying to explain this to a boomer, they always use the same example. They go, ‘well, my interest rates were 15%, you have six and a half, you’re so lucky.’ Well, let’s look at it this way.”

Image credits: fmsmith319

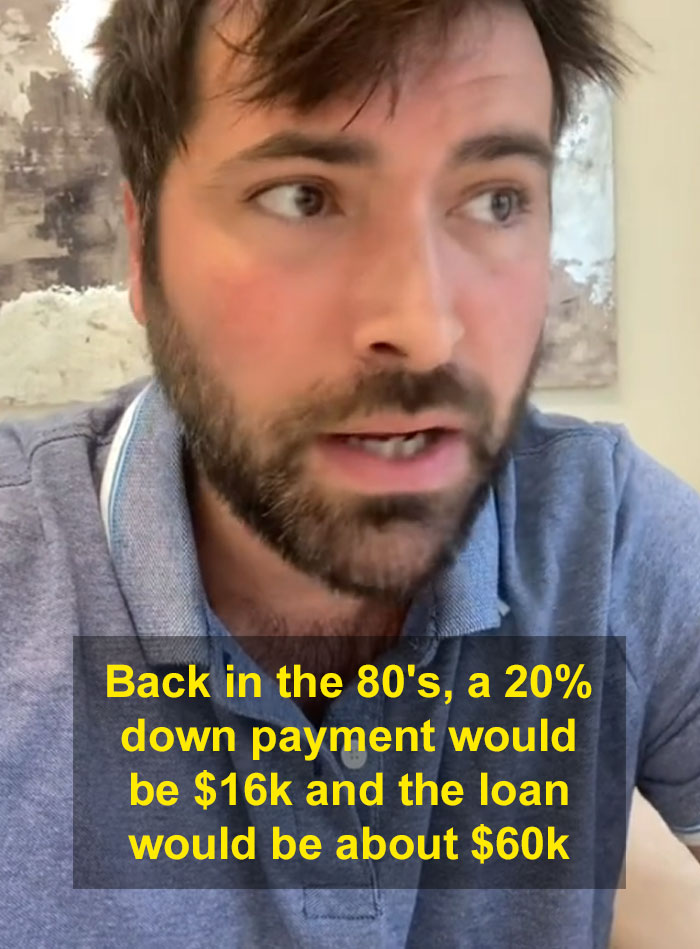

“If you bought a house for $80,000, back in the ‘80s, a 20% down payment would be 16 grand, and the average person was making around $30,000 back then. So your down payment was just half your yearly salary.”

“And then the loan you would have on it would be about $60,000. So in order to pay off the $60,000, if you really wanted to, it’s just two years of your salary, and you could have your house paid off.”

Image credits: fmsmith319

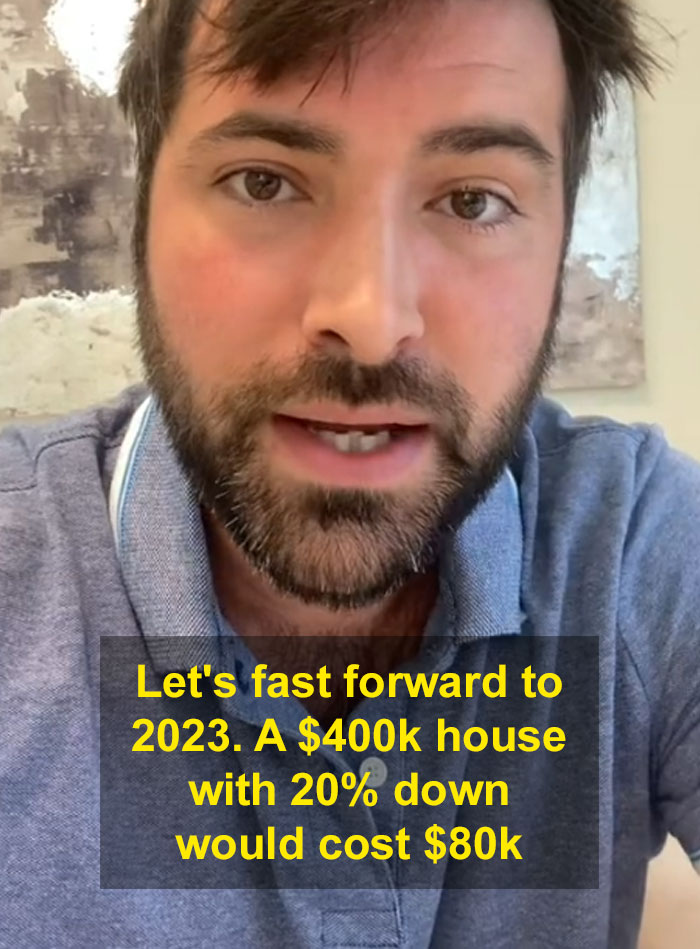

“Well, let’s fast forward to 2023 and I live in Orlando, so I’ll use this as an example. A $400,000 house with 20% down would cost $80,000. Just as the down payment. The average person makes $50,000.”

“So it’s almost twice their yearly salary just for the down payment, then they’ve got a $320,000 loan left that they have to look at.”

Image credits: fmsmith319

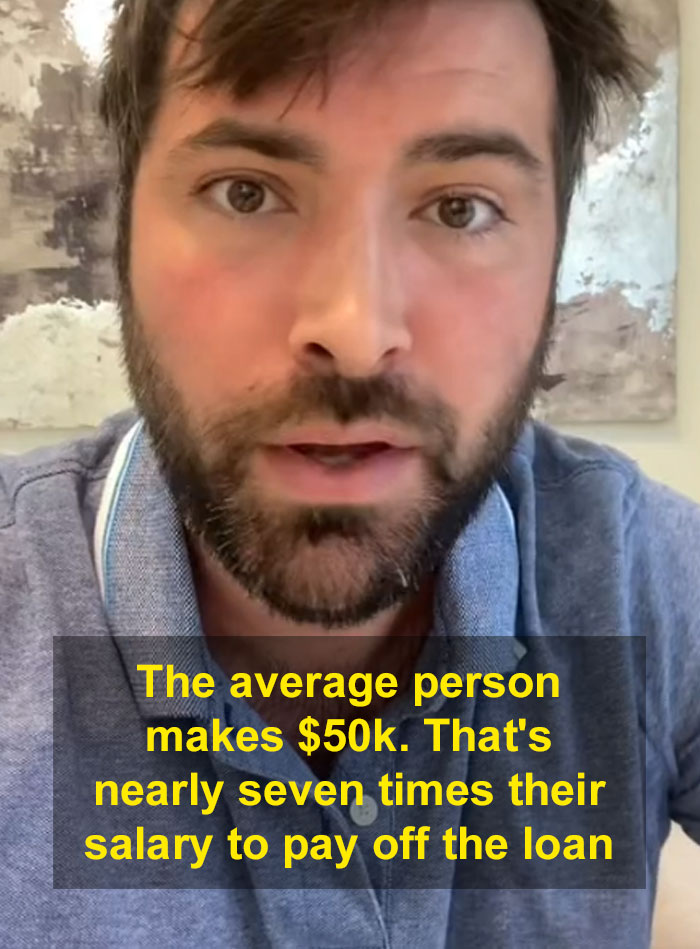

“That’s nearly seven times their salary to pay off the loan, regardless, and then you go ‘well, 15%, we had a higher payment.’ All the people buying houses right now, I’m a real estate agent here, so I see this all the time.”

“It is incredibly rare that people are putting 20% down, people are putting three to 5% down, which is what the 6% interest rate is still shooting the mortgage through the roof. People’s payments on these homes are $3,300, $3,500 a month, on an average, simple, three-bed, two-bath home. So that’s the difference.”

Image credits: fmsmith319

“Millennials are complaining and people can’t get mortgages. I don’t know the answer to it. But I’m in this stuff every single day and most of our clients, I’m not kidding you, are in their 50s, 60s and 70s.”

“It is so rare for us to see a millennial or especially anyone younger, except a couple the other day, and the agent pulled me aside and said ‘hey, they gotta send this video to their parents because they’re the ones paying for it.’ Good for them. That’s awesome. But that’s the situation that millennials are in.”

@fmsmith319 Replying to @JosiahFuerte ♬ original sound – Freddie Smith

Image credits: fmsmith319

Millennials, who include people born from 1981 to 1996, have had it real rough. As they became adults, the oldest of the cohort faced the housing crisis and the Great Recession of the late ’00s, while the youngest graduated from college right into the pandemic.

Since their lives have been plagued with student debt and economic uncertainty, no wonder most of them had been renters.

However, according to a study by RentCafe, in 2022, Millennial homeowner households become a majority among the generation, at 51.5 percent.

Over the past five years about seven million Millennials have joined the ranks, bringing the total to about 18 million, and even thought that’s more than triple the gains of Gen X (born 1965 to 1980), which added 2 million new homeowner households, for a total of about 24 million, Millennials still own fewer homes than older generations do.

Baby boomers (born 1946 to 1964), still own the most homes, about 32 million, but lost around 350,000 homeowners during the same time period.

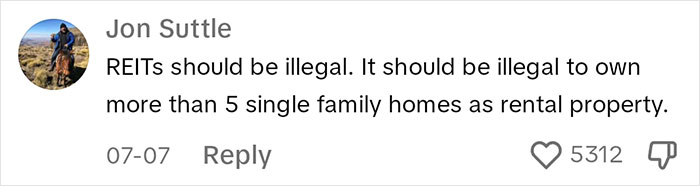

Smith’s video really resonated with people, and inspired many to share their personal stories

The post Realtor Explains Why Millennials Struggle To Buy Homes, Goes Viral first appeared on Bored Panda.

from Bored Panda https://ift.tt/xcl0fTb

via IFTTT source site : boredpanda