The passing of a loved one is supposed to bring the rest of the family together. However, if there’s a sizeable inheritance up for grabs, it might end up ratcheting up the tension and causing drama left, right, and center instead.

Redditor u/throwaway-929300 shared how her estranged grandfather left her a sizable inheritance in the millions. Most of her family members tried to pressure her into splitting all of the money among them. So much so that she felt confused and turned to the AITA online community for advice. Scroll down for the full story, as well as the all-important update about what the OP decided to do next.

Bored Panda got in touch with personal finance expert Rick Orford, the author of ‘The Financially Independent Millennial,’ who was kind enough to shed some light on why inheritances can turn relatives against one another. He also shared his thoughts on what someone who has just inherited a large sum of money ought to do.

Inheriting a large sum of money can, in some cases, make your family turn against you out of envy

Image credits: Mikhail Nilov (not the actual photo)

One woman shared how her relatives began pressuring her to split the money her grandfather left her

Image credits: Andrea Piacquadio (not the actual photo)

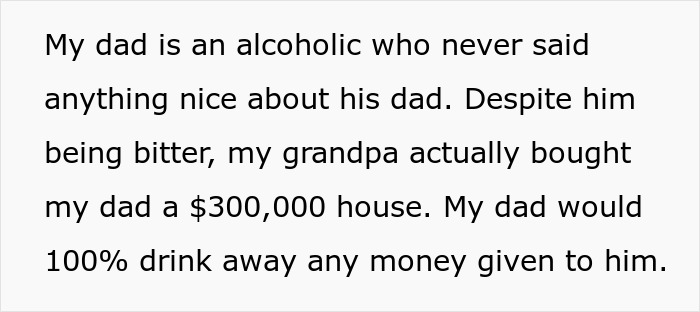

Image source: throwaway-929300

After a month, the author shared an update about what she decided to do with the $8 million she got

Image source: throwaway-929300

The woman’s family thought that she didn’t ‘deserve’ the inheritance

Unfortunately, dividing up someone’s inheritance can bring out the worst in people, even if they are your relatives. Or, depending on your point of view, especially if they’re your relatives. With a jaw-dropping $8 million up for grabs, it’s no wonder that some of the post author’s family members went a bit overboard showing their greed.

In the end, the young woman decided that she’d help out two people: her mom, who always had her back, as well as her younger sister. “I bought her a new car, paid off her medical bills, and am helping her move into her new apartment. She only works one job now, and I’m trying to give her everything,” the OP wrote about how she rewarded her mom.

She also set up an account for her younger sister so that she’d have enough money for college, a car, and a down payment on a house. However, the author noted that nobody else would get a penny. Meanwhile, she also donated some of the inheritance to charity and put what was left into credit default swaps (CDS).

The woman was incredibly grateful for all of the support and advice that the Reddit community gave her. “I was scared, lost, and overwhelmed. I couldn’t have done this without all the support and advice I was given,” she shared.

It’s essential to seek advice from a qualified financial advisor with a fiduciary duty to their client

Personal finance expert Orford, the author of ‘The Financially Independent Millennial,’ told Bored Panda that large inheritances that leave out close family members are likely to cause a stir.

“Money is the root of all evil, and considering many live paycheck to paycheck, it makes sense some will bark if they feel left out. If the beneficiary doesn’t want to share, it’s their prerogative, but remember that it could impact the relationship,” he explained.

“We don’t get to choose our family; nurturing these relationships is important. We could do this by segmenting a portion of the inherence and dividing it equally among the family members. It might not be a legal requirement, but it could be the morally correct thing to do,” Orford suggested.

“Should a beneficiary want to do this, they’ll want an agreement drawn up by an estate attorney to ensure no further claims will be made at a future date,” he warned.

Meanwhile, we were curious about how someone might want to invest their inheritance. According to the personal finance expert, the person first ought to consider their age, current financial needs, and risk tolerance.

“For example, someone at the beginning of their career will have a higher risk tolerance and invest in something very different than someone near or at retirement age,” Orford explained to Bored Panda.

“Suppose the beneficiary is new to investing and wants to invest their money (and make it last). In that case, they should seek advice from a qualified financial advisor with a fiduciary duty to their client. A fiduciary means the advisor legally acts in the client’s best interest—very few have this qualification. Having a fiduciary means you’ll be more likely to keep your money for the long term (and not make mistakes),” the author of ‘The Financially Independent Millennial’ advised.

Gratitude is the antidote to envy

There’s nothing wrong with looking out for your best interests and ensuring that you and your loved ones thrive, not just survive. After all, wealth can help make life easier in a lot of ways. It offers better education, higher quality food, access to time-saving services, the ability to buy property and travel freely, and it provides a safety net for the future. However, you shouldn’t let the desire to live a good life morph into boundless envy and greed.

Probably the best way to keep envy in check is to slow down and focus on gratitude. Think about all of the things in your life that you are genuinely thankful for, whether that’s your health, having a roof over your head, meaningful relationships, a loving family, a steady and purposeful job, or something else.

Recognizing how much good there already exists in your life can put someone else’s inheritance into perspective: you don’t necessarily need millions of dollars to live well. At the end of the day, what matters the most are your relationships, health, and living according to your values.

The quality of your relationships is more important than wealth

An 85-year study conducted by researchers at the University of Harvard concluded that what makes us the happiest in life are our positive relationships. They also help maintain our health and help us live longer. So it’s your relationships, rather than more wealth, that you may want to consider focusing your ‘investments’ in.

However, it seems like envy is exactly what got the best of most of the author’s family members. She shared how her relatives told her that she was being “unfair” and that the money supposedly didn’t belong to her. They also assumed that she’d “waste” the money “on cards and clothes.”

It’s unfair to assume that just because someone’s young, they’ll be financially irresponsible. Making responsible decisions has more to do with spending habits, experience, temperament, and knowledge than just someone’s age. From what the woman wrote in her story and update, she seems to have a very grounded outlook and was aiming for stability in her future.

Most readers thought that the woman was perfectly right to resist her relatives’ pressure

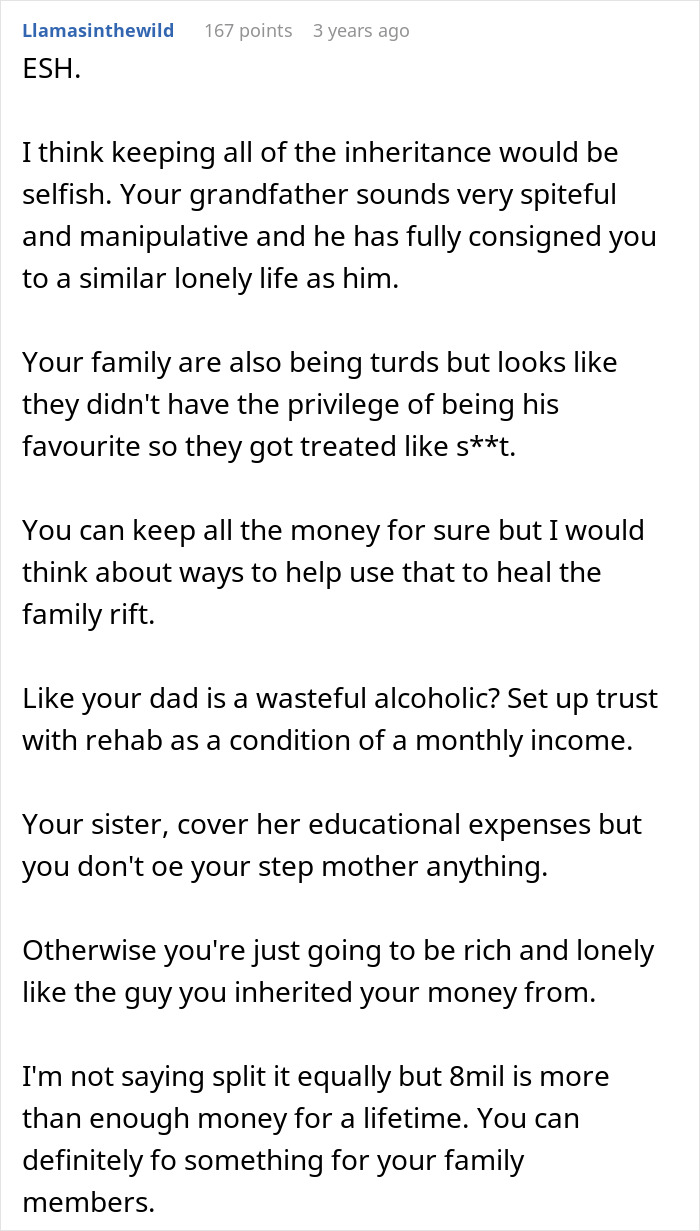

Other internet users, however, had a different take and thought she should have behaved differently

The post Woman Inherits Millions From Her Estranged Grandpa, Won’t Share It With Her Family first appeared on Bored Panda.

from Bored Panda https://ift.tt/4kKOgqt

via IFTTT source site : boredpanda