Prices are always rising, and we’re just trotting along trying to keep up. Whether it’s the increased cost of housing, food, fuel, essentials, or chocolate (yes, you heard that right), it seems like there’s almost no escape from inflation. The only problem is that prices are rising way faster than we’d ever expect.

This came to light in a shocking way after a TikToker showed his 2022 bill for 45 groceries and compared it to the price it would be today. People could not believe how insanely hiked up the costs were.

More info: TikTok

Shocked TikToker tries to reorder the same groceries he had bought two years back, cannot believe that the price is 3 times what it had been

Image credits: freepik (not the actual photo)

The man starts off the video by saying, “I feel like I’m gonna be sick”

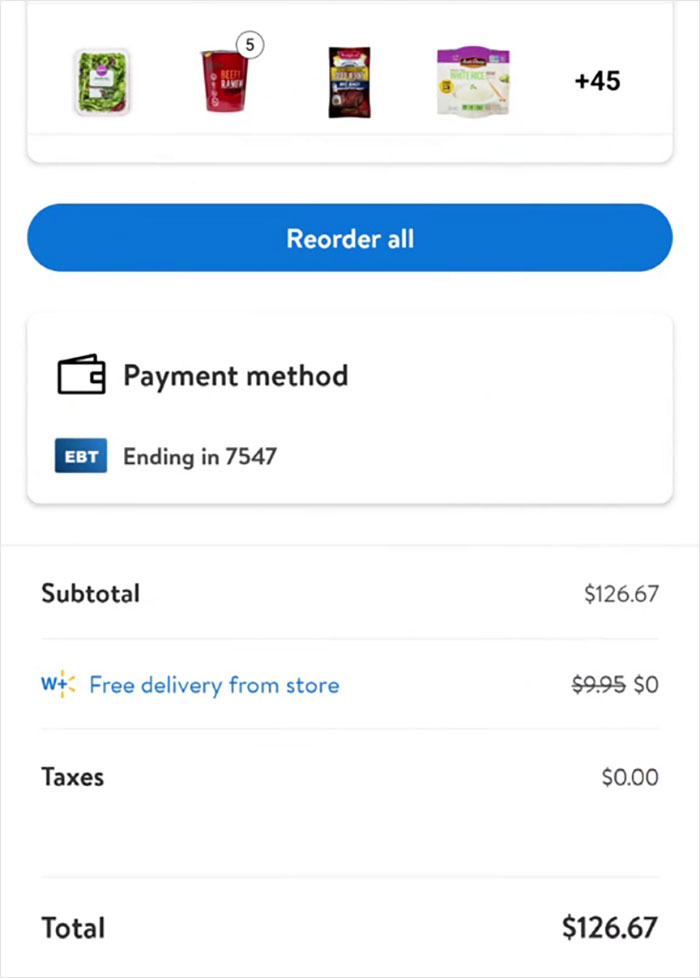

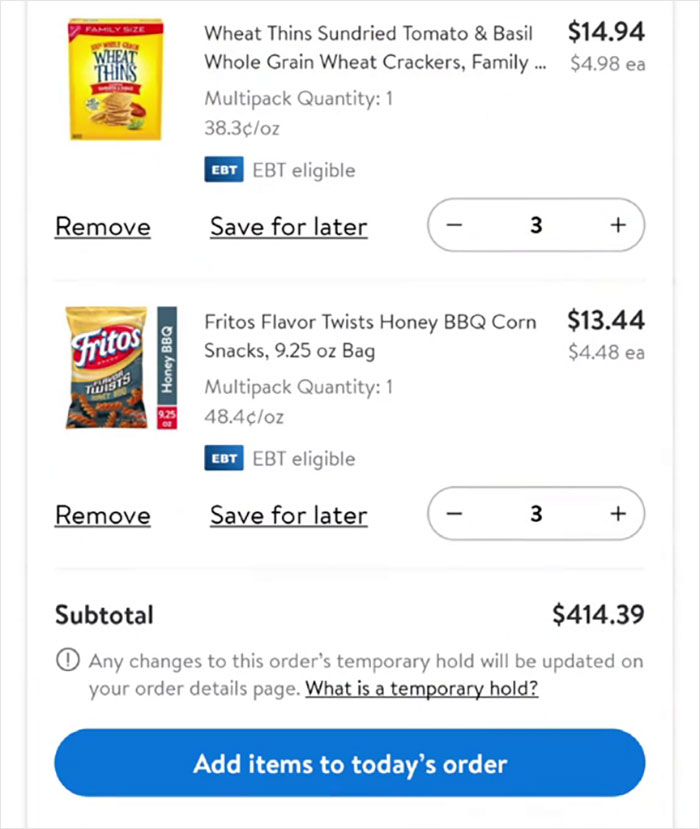

Dakota Neifert, the TikToker in question, had been going through his Walmart grocery history. He came across a receipt of $126 for 45 items from 2 years back, saying, “a whole month of groceries just for me, basically.” He saw the reorder button and decided to check how much it would all cost now. But, to his surprise, the price had tripled to $414.

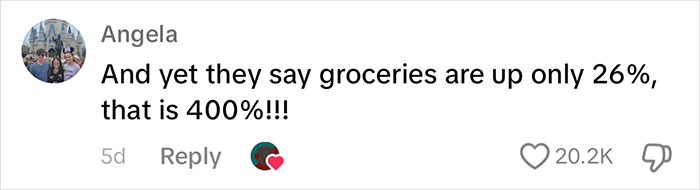

The worrying thing is that the U.S. inflation rate is supposed to be at 3.27%. But videos like this show that the cost of everyday items is rising exponentially. How can that be possible if the inflation rate is staying steady around 3-4%?

Image credits: sewerlidd

The TikToker could not believe that 1 month’s worth of groceries could cost $414, and he said, “that is four times more. How the heck? How?”

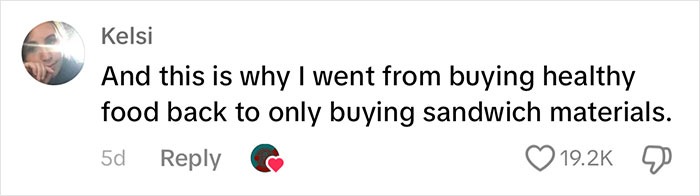

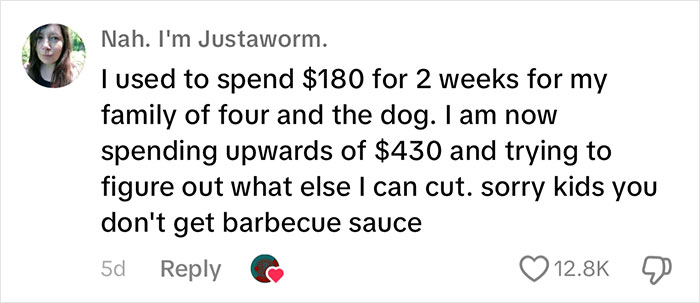

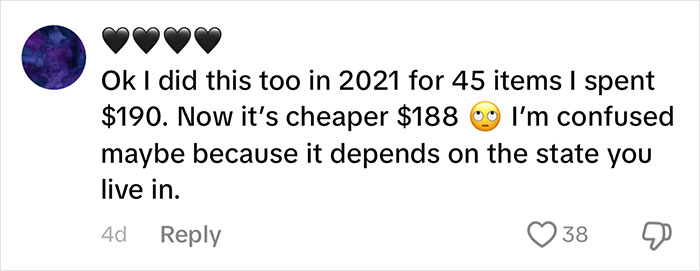

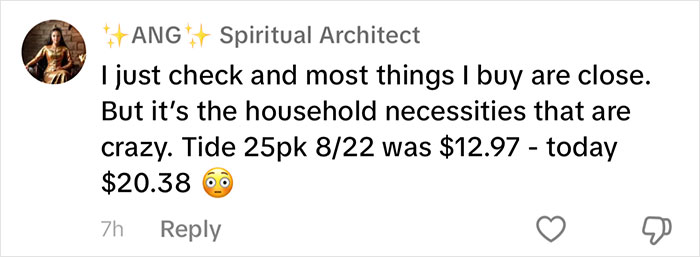

Many commenters thanked the guy for making the video, because it validated their feelings about skyrocketing prices. Some even said they struggled to put food on the table because of expensive groceries and necessities. The sinister effect of inflation is seen in people’s decreased purchasing power, meaning that the same amount of money buys much less during high inflationary periods. I wonder how many items the guy could have bought from his 2022 shopping list with $126?

Image credits: sewerlidd

Image credits: sewerlidd

You can find the eye-opening video here

@sewerlidd #greenscreen #groceries #economy #inflation ♬ original sound – Sewerlidd

What are people supposed to do if everything is becoming way more expensive?

Image credits: pressfoto (not the actual photo)

According to Forbes Advisor, “if you can’t buy as many goods and services as you did before inflation, your quality of living will eventually diminish.” In this video, the price of 45 groceries shot up more than three times their original price. If everything becomes that expensive, eventually, people will only have money to buy essentials, and everything else will have to take a backseat.

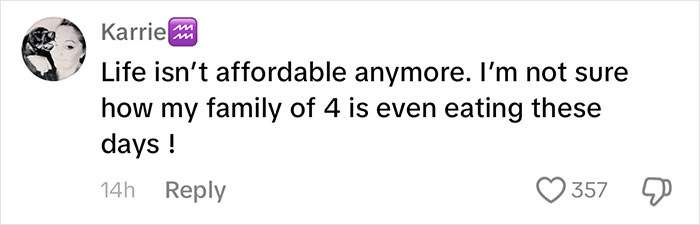

What’s worse is that these inflated prices tend to hit low-income households harder because things like gas and food make up a larger part of their budgets. People are spending nearly 7% more on essentials than they did before 2020. This leaves almost no room for small luxuries or just going out for dinner occasionally.

Inflation might seem like such a killjoy, and it almost makes you wish the reverse was true. What if prices dropped and people could buy way more with the same amount of money? But it turns out that deflation is no cakewalk, either. It can also lead to a depression (erm, the Great Depression), leading to high unemployment and lower production rates.

The Federal Reserve does take steps to prevent inflation from dropping too low or climbing too high. Their sweet spot is around a 2% annual rate of increase. So if it goes too high, they raise interest rates and try to slow the economy’s growth; if it drops too low, they try to lower interest rates. Hopefully, they also watched this video and are trying to make things right.

Image credits: frimufilms (not the actual photo)

Although we’ve painted inflation as a horrible scenario, there are a few situations where it’s not all that bad. For example, debtors find it easier to repay their loans because their debt has less worth during an inflationary period. It’s also a better time to buy property because of the diminished housing market.

After having watched Dakota’s video, there’s one thing we all can probably agree on, and that is inflation may be just around the corner. Everyone needs to be prepared for the possibility, which is why we put together a couple of steps you could follow to protect yourself against inflation:

- Don’t only hoard cash because it may lose value over time, the better idea is to invest your money.

- When it comes to investing, you should try to put your money in stocks, bonds, and other assets like gold that can withstand inflation.

- Along with your investments, always prioritize an emergency fund.

- Don’t forget to get help from a financial advisor to know whether you’re on the right track.

The $288 price jump in the TikToker’s video is certainly jaw-dropping. But it reminds us of something important that nobody really wants to believe–things will keep getting more expensive. We must do everything we can to protect ourselves against inflation. It also helps to read up on the subject and arm ourselves with the right facts. Till then, shocking videos like this will keep bowling us over.

Do you have any examples of huge price jumps like this? Please share your experience in the comments so that others can learn from it.

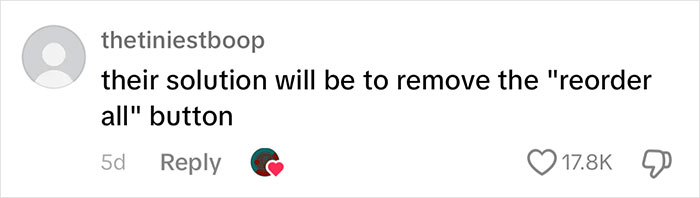

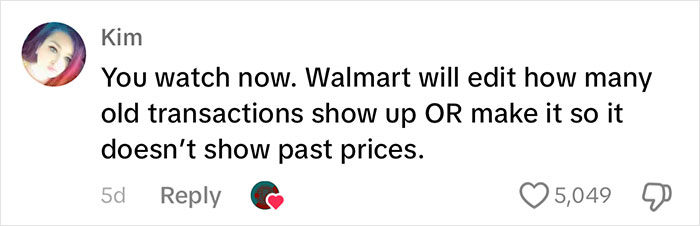

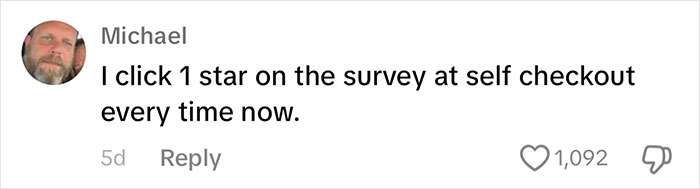

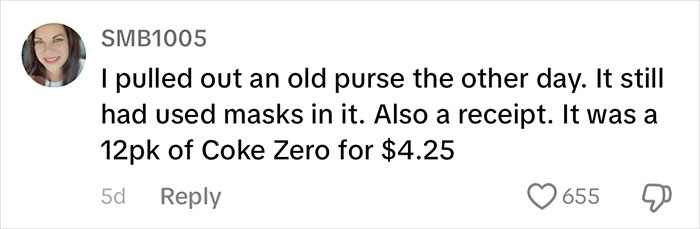

Many commenters agreed that with such high prices, it is becoming tougher and tougher to afford normal everyday items

The post TikToker Reorders The Same 45 Items He Did In 2022, Is Horrified Seeing How Prices Have Tripled first appeared on Bored Panda.

from Bored Panda https://ift.tt/5igs7xc

via IFTTT source site : boredpanda