Major hedge funds had bet billions of dollars that GameStop’s shares would fall but they have faced major losses after Reddit users drove up the share price (it was $19 at the start of January but reached $330 in mid-afternoon on Wednesday in New York). These people see it as both a troll of the hedge funds they call “parasites,” and a real attempt at making big bucks.

However, Robinhood and other popular online brokerages restricted trading in the high-flying stock, enraging individual investors who have sent it skyrocketing in recent days.

These restrictions virtually left traders with only two options: hold or sell.

They also fueled a firestorm of criticism among users and even some members of Congress who have called for hearings on the matter.

Disappointed and furious, investors who were getting the best of seasoned professionals interpret the trading restrictions as the latest sign that financial markets are stacked against individuals.

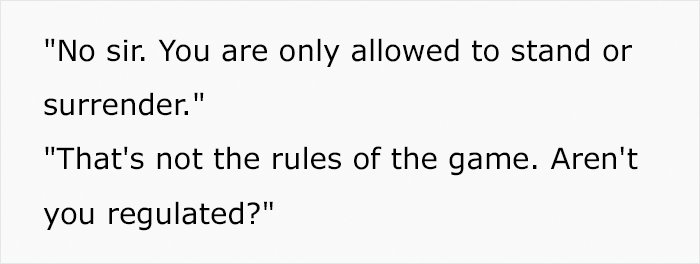

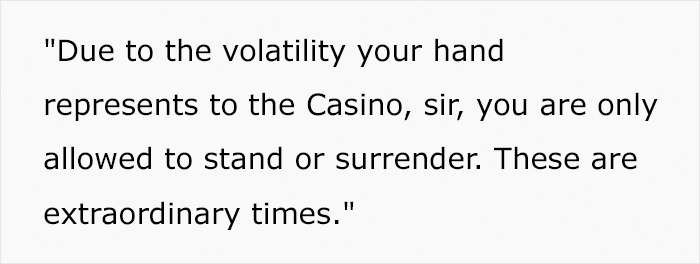

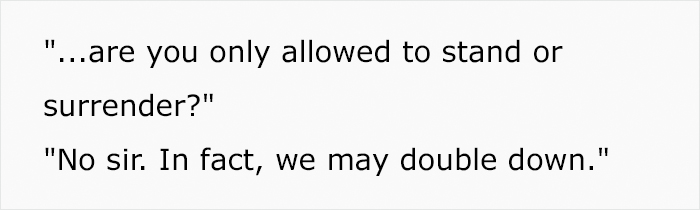

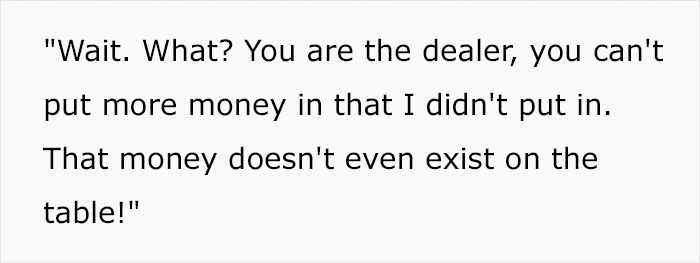

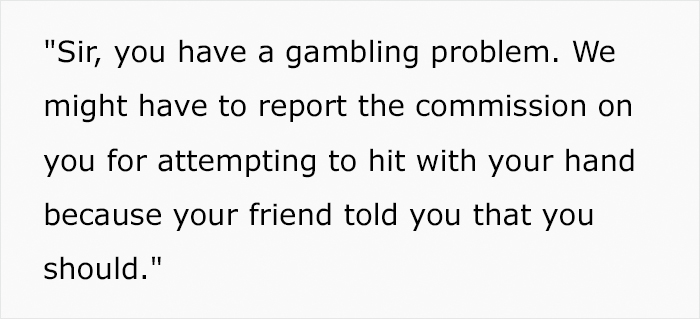

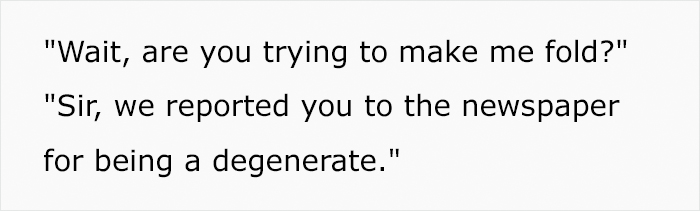

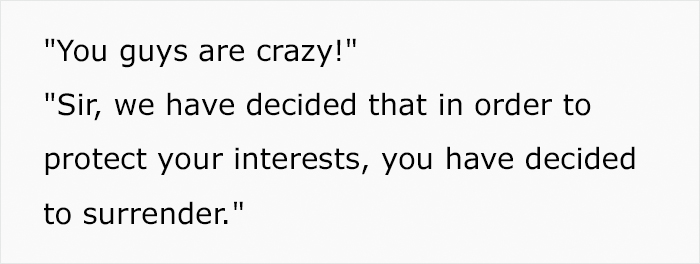

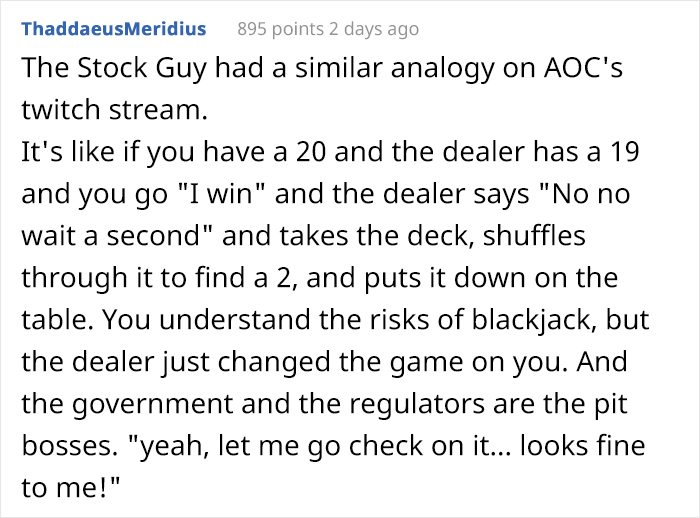

Trying to make sense of it all, Reddit user Palidor206 posted an analogy of the situation using a casino as an example and it’s clear there is no sense at all.

Image credits: Anna Shvets

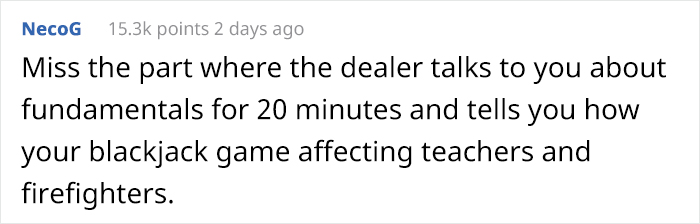

People think the analogy is spot-on

The post This Casino Example Illustrates How Billionaires Are Exploiting Ordinary People Who Want To Invest In $GME first appeared on Bored Panda.

from Bored Panda https://ift.tt/2YBpTL6

via IFTTT source site : boredpanda