The topic of inheritance can often come with mixed feelings. It can be a huge relief to suddenly see a large sum of money coming your way, but most of us would much rather have our parents around than be able to afford a new home. And along with inheritances often comes some family drama surrounding who’s entitled to what.

One teen recently found out that he would be receiving a substantial sum of money that his mother set aside for him before she passed away. His father, however, believes that he deserves some of the money to take care of himself and his new family. Below, you’ll find the full story that was shared on Reddit, as well as some of the replies invested readers shared.

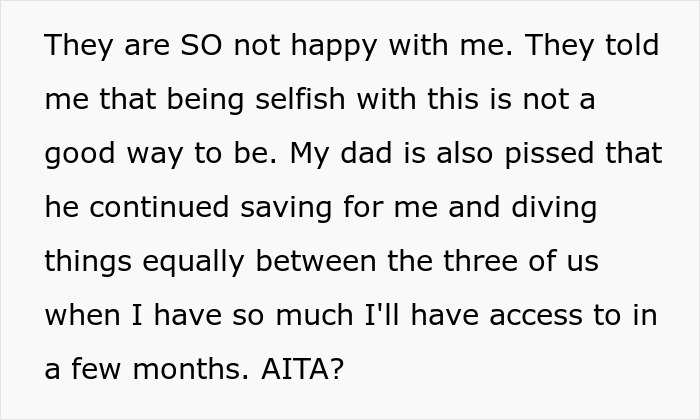

This teen recently found out that he would be inheriting a large sum of money from his mother’s side of the family

Image credits: ASphotostudio (not the actual image)

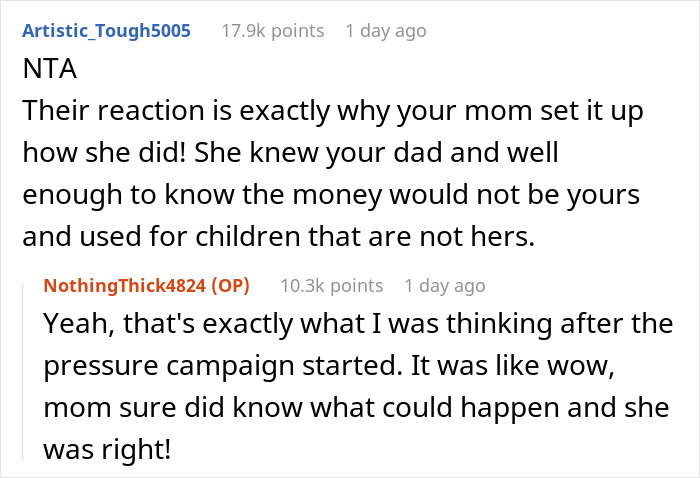

But his father and stepmother believe that they’re entitled to some of the funds too

Image credits: Kindel Media (not the actual image)

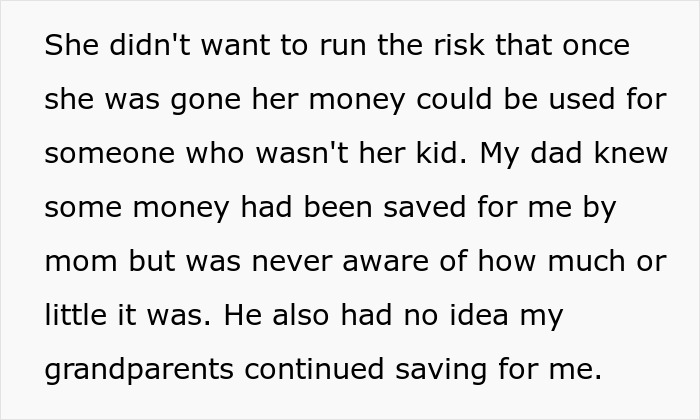

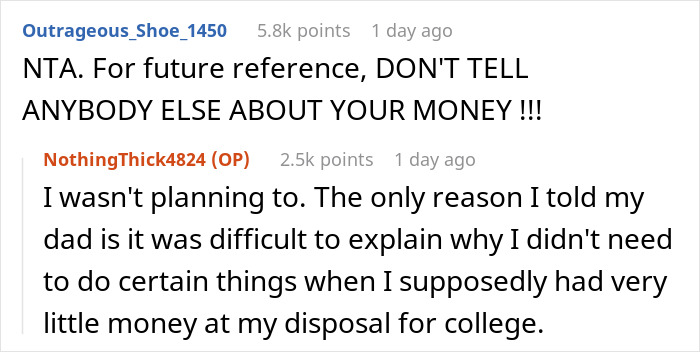

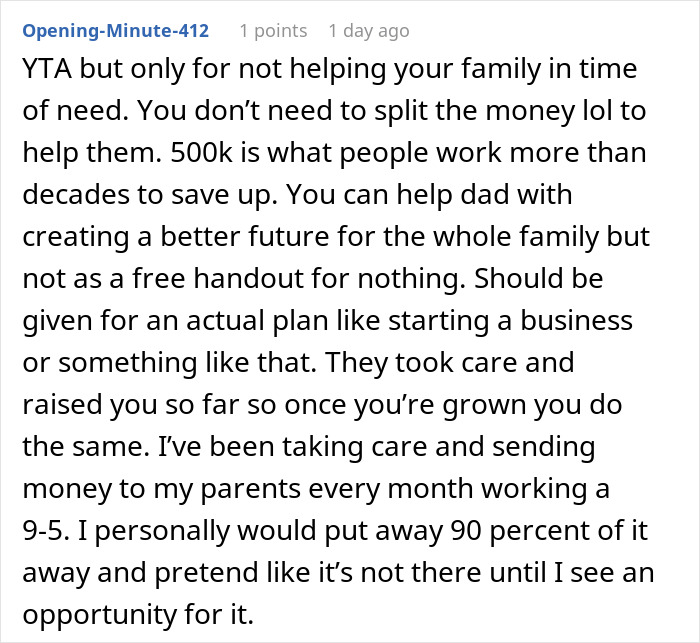

Image credits: NothingThick4824

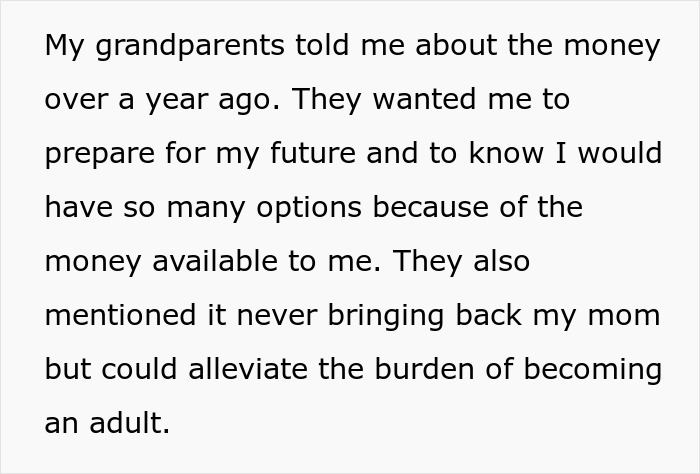

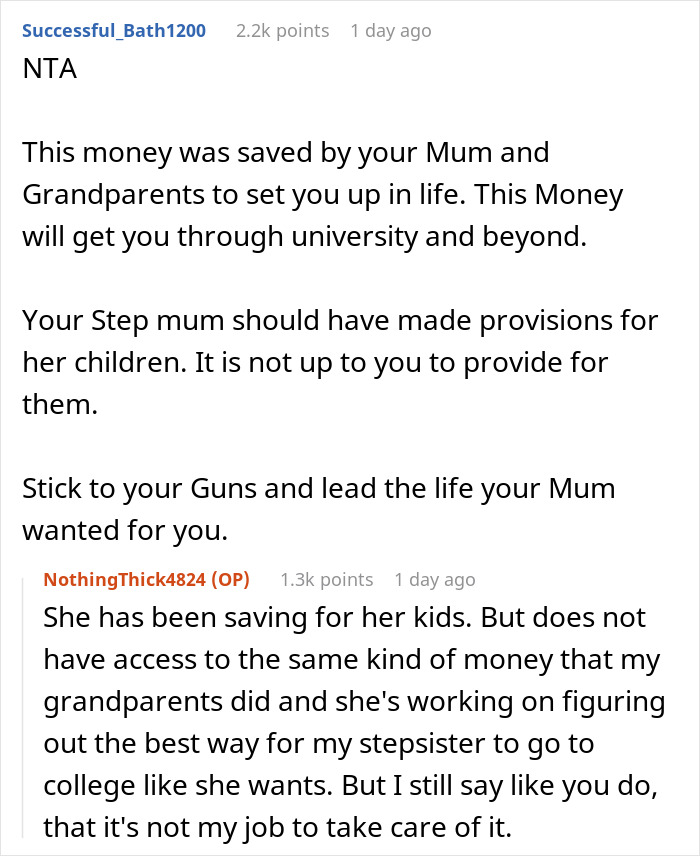

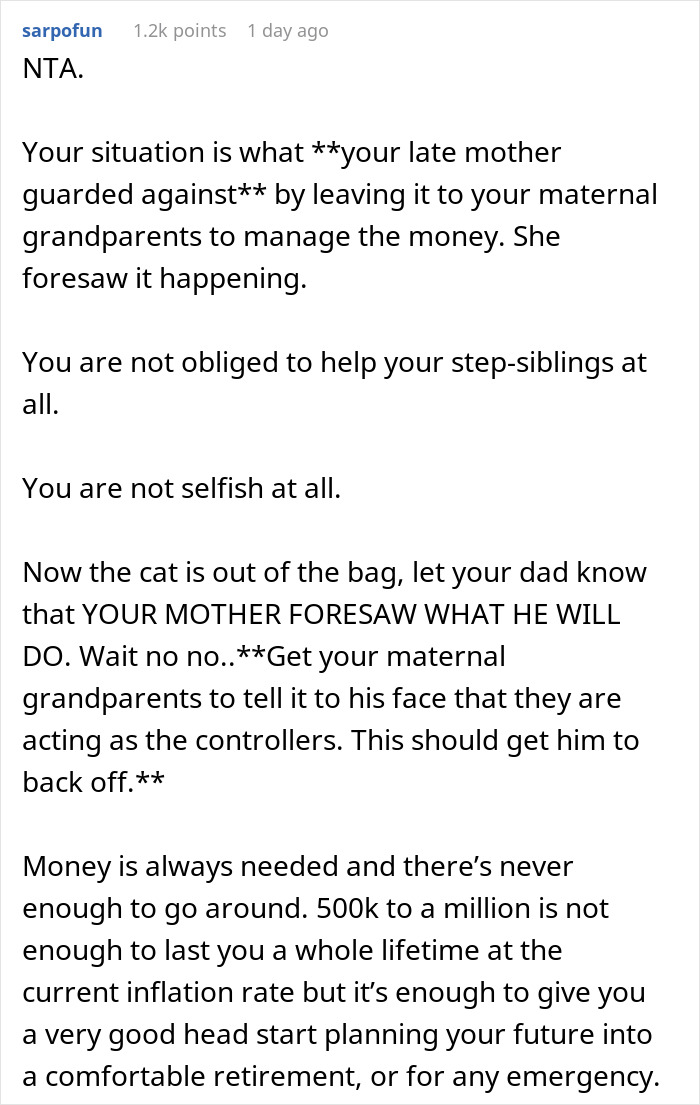

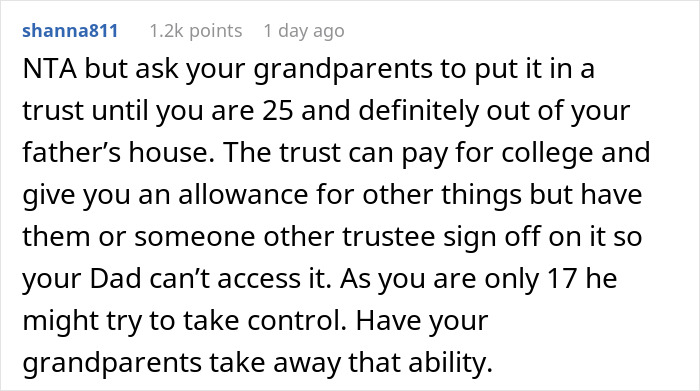

Later, the teen responded to some replies from readers and provided more details on the situation

The average person doesn’t actually inherit very much from their family

Inheritance is often something that we don’t want to think about until we absolutely have to. I can’t even fathom the thought of my parents not being here, and I hope it’s something I won’t have to worry about for a very long time. But when the time finally comes for a beloved parent to pass, many people find themselves inheriting whatever funds and assets their parents had in their names.

According to SmartAsset, American households inherit an average of $46,200. But because some people find themselves inheriting millions, there are many on the other end of the spectrum who find themselves with nothing left from their parents at all. In fact, less than a third of all households inherit anything, while those in the top 1% inherit an average of $719,000.

There’s also a substantial gap between how much individuals expect to inherit from their families versus how much they actually receive. Those in the top 1% typically believe that they’ll see over $900k coming their way, and those in the next 9% expect to see about $266,600. In reality, they’re likely to receive about $174,200. Even in the bottom 50%, where people receive an average of less than $10k, people still assume they’ll receive nearly $29,400.

It’s wise for parents to specify exactly where they want their assets to go when they’re gone

When it comes to setting funds and assets aside for their children, there are many factors for parents to consider. Kids can inherit bank accounts, real estate, land, vehicles, investment accounts, personal belongings, and more, but of course, most states in the US won’t allow children to put these things in their name until they’re over the age of 18.

That doesn’t mean parents can’t leave things to their kids when they’re still minors though. SmartAsset explains that moms and dads can create a last will and testament that specifically notes who they want to inherit what. They might also choose to establish a trust that will hold onto assets for their kids and is overseen by someone who can give the children their inheritance at an appropriate time. For example, parents may choose to give their children access to their funds after they graduate from college or once they turn 30.

Apparently, some states in the US do not allow individuals to exclude their spouse from their will if they’re currently married. But it appears that in this case, the mother may have spoken to a financial advisor or simply left the money with her parents trusting that they would give it to her son when he turned 18.

Disputes often arise in families surrounding inheritance

Because of the large amounts of money sometimes involved and the heightened emotions of grieving a loved one, disputes often arise in families surrounding inheritance. Willed explains on their site that drama might crop up because multiple people want the same physical assets, siblings feel they haven’t inherited equal amounts, or perhaps divorce has caused disruption in the family.

In this case, however, it’s difficult for the father to claim that he’s entitled to his son’s insurance because he hasn’t been married to his son’s mother for a decade. The Private Office notes that when a couple divorces, for example, the assets that they shared are often seen as joint and split between the two of them. In the future, however, an ex-spouse can try to claim inheritance, but they probably won’t be successful.

Inheritance may or may not be considered a joint asset, but if you’re really concerned about the possibility of an ex receiving your assets, it’s always wise to sign a pre-nuptial (or even post-nuptial) agreement just in case. We would love to hear your thoughts on this situation in the comments below, pandas. Do you think this teen is wrong for keeping his inheritance to himself? Feel free to share, and then you can check out another Bored Panda article discussing inheritance drama!

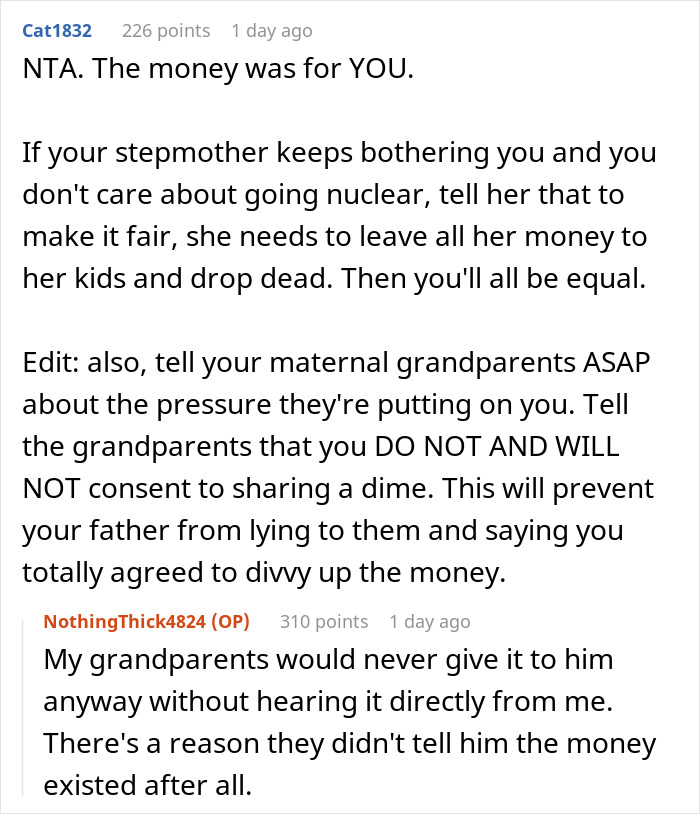

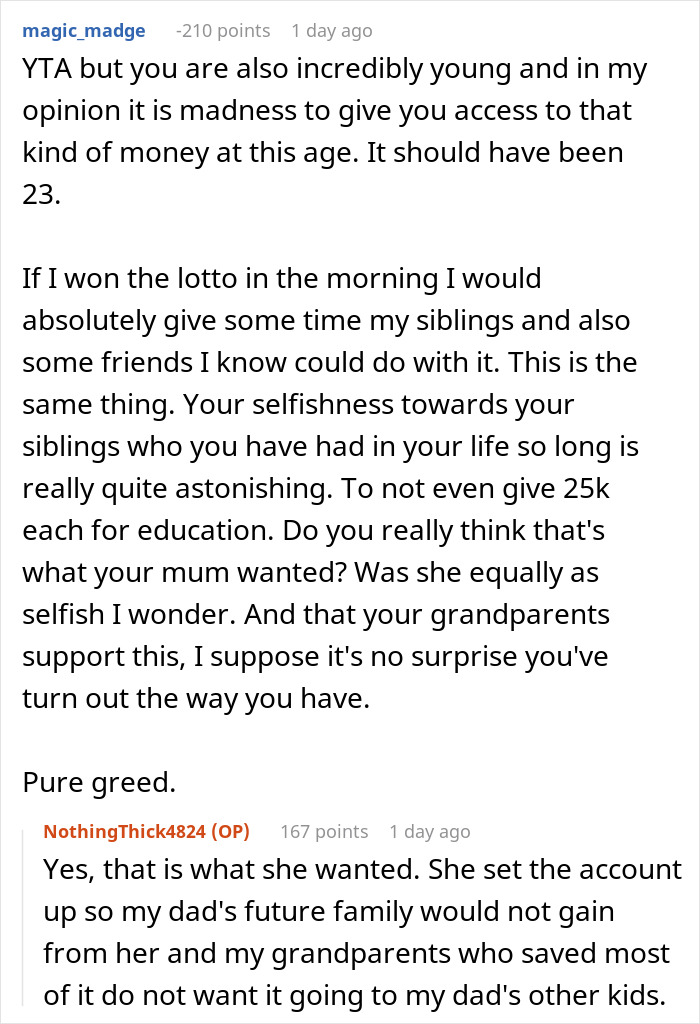

Most of the readers agreed that there’s nothing wrong with the teen keeping the money for himself

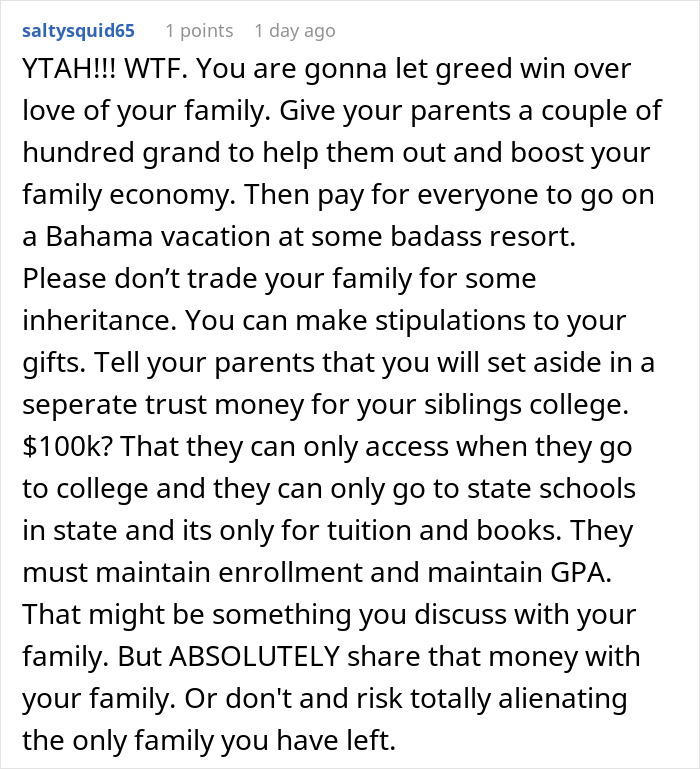

Some, however, thought that he should share at least a small amount with his family

The post Teen Inherits Over $500K From His Mother, Dad And Stepmom Pressure Him To Share The Money first appeared on Bored Panda.

from Bored Panda https://ift.tt/XpwVOlL

via IFTTT source site : boredpanda