The last few months have forced many folks to engage in an unwanted crash course on basic economics. On the one hand, it’s good for more folks to get first hand experience with some of the financial building blocks of the world, on the other hand, it’s somewhat surprising how many people were not at all aware of what some words actually mean.

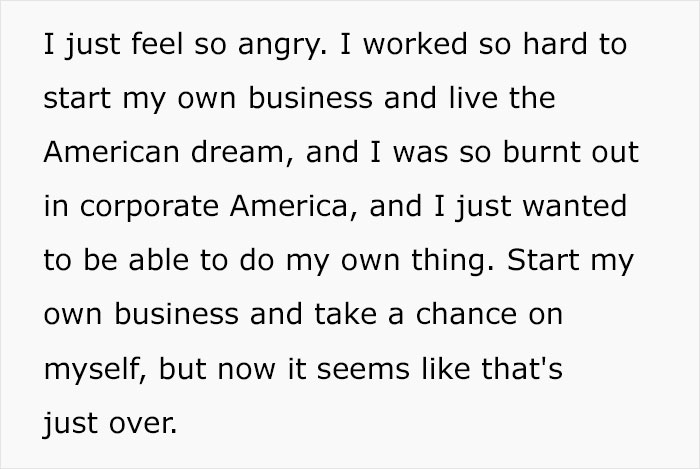

Content creator and small business owner Lexi Larson shared how US tariffs on Chinese goods would very likely ruin her company. We reached out to her via email and will update the article when she gets back to us.

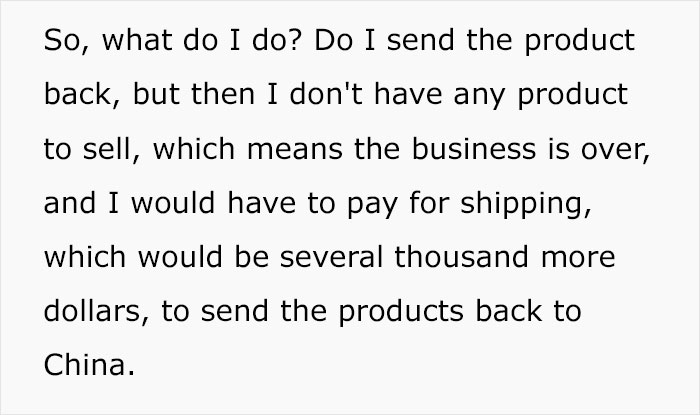

Economic uncertainty makes it pretty hard to run most businesses

Image credits: itslexilarson

So one woman shared exactly how the incoming tariffs on China could ruin her business

Image credits: itslexilarson

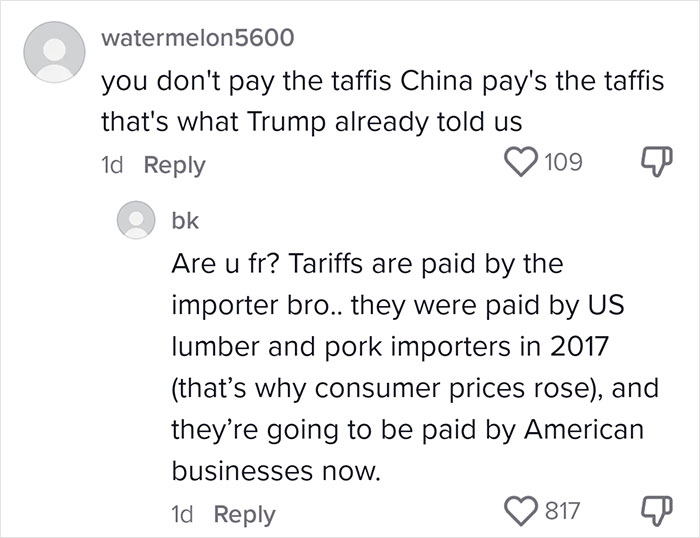

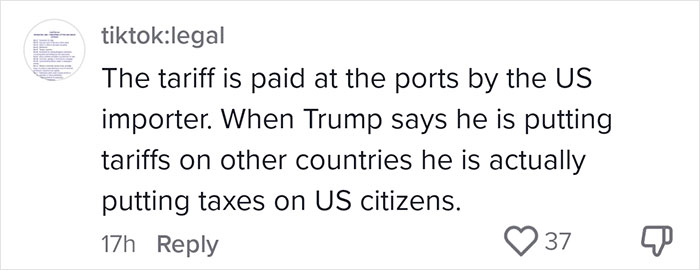

There are a lot of misconceptions about tariffs

A tariff is basically a tax that a government puts on goods coming in from other countries. Think of it like an extra fee you have to pay when you buy something from abroad. The idea is to raise the price of those imported items, which can help local businesses that make similar products by giving them a bit of a price advantage.

Here’s how it works: Imagine you want to buy a pair of shoes made in another country. Without a tariff, the shoes might be sold at a certain price. However, when the government adds a tariff, the importer has to pay extra on those shoes. To cover that cost, the importer raises the price when selling the shoes in your country. So, you end up paying more for those imported shoes than you would if they were made locally without the added tax. This is very important, as some folks, including some commenters, were adamant that, in this case, “China” would pay. This is false.

Governments may impose tariffs for a couple of reasons. One is to protect local jobs and industries. By making imported items more expensive, local products become more attractive to consumers because they’re cheaper in comparison. Another reason is to generate revenue for the government. In the case of the US, the profits from the last wave of tariffs were used to bail out farmers who suffered from, you guessed it, those exact tariffs. Despite the claims of the administration, this is not a way to get free money.

Businesses and manufacturers suffer from these disruptions

Image credits: CHUTTERSNAP / Unspalsh (not the actual photo)

High tariffs can hurt supply chains and businesses in significant ways. When tariffs are set too high, companies that rely on imported materials or intermediate goods face increased costs, which can disrupt their production processes. For instance, a manufacturer might need to source critical components from overseas; if high tariffs boost those costs, production becomes more expensive and less competitive. This not only affects the profit margins of individual companies but can also lead to higher prices for consumers, as businesses pass on these added costs.

Moreover, high tariffs can force companies to reconfigure their supply chains. While some businesses may attempt to source materials from domestic suppliers instead, not all products or ingredients have local alternatives that can match the same quality or volume. This forced shift can result in delays, reduced efficiency, and even compromise the overall quality of the final product.

In a global market, where speed and reliability are crucial, such disruptions can weaken a company’s competitive edge. One example is the idea of making the iPhone in the US. Even by quite generous estimates, this would at least $290 to the price tag, if not more. There are already examples of US manufacturers shutting down plants and projects, as they expect a downturn in revenues. For example, a CNC machine producer is cutting spending and Microsoft is backing out of a billion dollar data center in Ohio. After all, most people already dislike their white collar jobs, they are not likely to want to stand in a factory for eight hours a day.

In the long run, it also hurts one’s ability to sell your products abroad.

On a broader scale, these high tariffs may trigger trade disputes or retaliatory measures from other countries. Tariffs are a two way street, most nations won’t just take them lying down. When one nation imposes steep tariffs, its trading partners might respond in kind, further increasing costs and uncertainty for businesses that operate internationally. This ripple effect can stifle global trade, reduce market access, and ultimately lead to economic slowdowns that impact both industries and consumers.

In essence, while tariffs can be a tool for protecting domestic industries and generating revenue, excessively high tariffs tend to backfire. They complicate supply chains, escalate production costs, and risk igniting broader trade conflicts that hurt businesses and consumers alike. Some argue that they might bring back manufacturing. However, it’s important to point out that US manufacturing was growing! Even more bizarrely, president Trump is set on canceling the CHIPS act, which was intended to help move the manufacture of semiconductors to the US. So much for “American factories.”

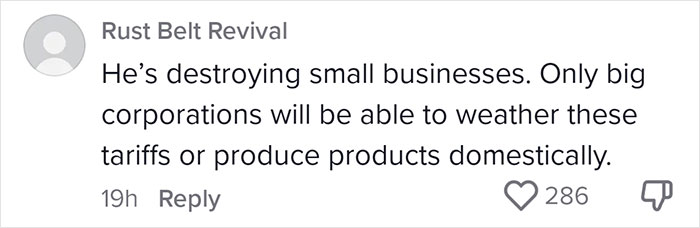

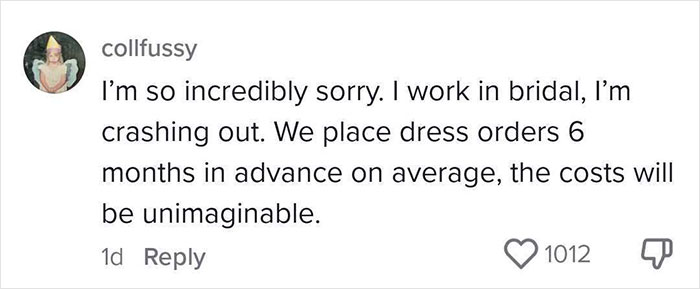

Some viewers seemed to have a lot of misconceptions about how tariffs work

from Bored Panda https://ift.tt/FDmXyhP

via IFTTT source site : boredpanda