Mixing money with family is like playing Monopoly – it starts off fun, but someone always ends up flipping the board. It’s a recipe for drama and sometimes epic meltdowns. Whether it’s lending a sibling some cash or investing in a relative’s big idea, money can turn even the closest relationships into a real family feud.

Our protagonist, John (we’ll stick with that name for now), learned this the hard way, when he moved closer to his in-laws to help them out and ended up in the middle of a real estate saga worthy of its own TV show. If you thought family drama was best left to soap operas, think again. We’ve got a juicy one here.

More info: Reddit

Couple spends $75k renovating the parents’ home, expecting to get it back after they pass away, once the house is sold, but the youngest sister inherits the house and asks them for tax money

Image credits: Sven Mieke (not the actual photo)

The couple buy a house close to the wife’s elderly parents to help take care of them and renovate their home, investing a lot of their own money into it

The husband expects to get the money back after the house is sold, but the younger sister inherits it and doesn’t want to sell it

Image credits: todd kent (not the actual photo)

The woman can’t afford to pay the $30K tax for the home, asks her sister to give her the money or she risks losing the family house

Image credits: Kinga Howard (not the actual photo)

Image credit: LateAfternoon9

“We poured enough of our own money into that pit”: the husband refuses to give his sister-in-law money to pay her taxes, leaving wife furious

Years ago, John and his wife made the noble decision to relocate near her elderly parents, snapping up a cozy house just a few streets away. But they weren’t just neighbors, as they soon became the parents’ go-to caretakers, investing a cool $75,000 into upgrading their home. We’re talking new carpet, shiny appliances, and even a couple of AC units that cost more than a luxury vacation.

The deal was that once the parents passed away, the house would be sold, and John and his wife would get their money back, with the rest of the profit divvied up among the siblings. Sounds fair, right? Wrong. Of course there is a plot twist in our story. If there wasn’t, you would probably not be reading about it right now.

When the wife’s parents passed away, instead of the anticipated sale and profit-sharing, the house was handed over entirely to the youngest sister. The parents left a heartfelt letter explaining they wanted to ensure she had a home, as she couldn’t afford one on her own.

All the other siblings were financially stable homeowners, so they easily accepted this decision. John, however, was less than thrilled. After putting so much of his own money into the house, it felt like their investment had gone up in smoke. “I was livid because we poured money into that house and now we’re not going to get it back,” John recalls. The couple argued for weeks, and John was fuming, until he finally calmed down, accepting the fact that he had lost that money, for the sake of his marriage.

After a few years when the real estate market went bananas, John’s house skyrocketed to $1.75 million. The sister-in-law’s home also saw a hefty appreciation to over $1 million. But, of course, with great property value comes great property taxes – over $30,000 a year, to be exact. Struggling with these payments, especially after her husband lost his job, the sister-in-law missed their tax payment, racking up huge penalties and interest.

With the taxman knocking on her door, John’s sister-in-law turned to her siblings for help. Unfortunately, everyone was financially drained, except for John and his wife. So, guess who got asked for a loan? Yep, you guessed it. John’s wife approached him, hoping they could bail out her sister. “The problem is that all of the siblings had financial difficulties last year so none of them could loan her money as they did in previous years. However, we’re doing okay so my wife asked me the other day if we could loan her sister the money,” John continues. His response? A resounding “no way, José!”

“We poured enough of our own money into that pit and refused her request,” John says. This sparked another round of arguments between him and his wife, escalating to the kind of shouting matches you’d expect to see on a reality TV show. John admits he might be a tad petty, but believes he is justified. After all, they’ve already lost $75,000 to her. His wife, on the other hand, can’t stand the thought of her sister losing their childhood home.

Image credits: Celyn Kang (not the actual photo)

While it is normal, and sometimes even expected, to help out your family when they are in need, acknowledging your own limits to generosity is crucial, especially when mixing money and family.

As explained in an article on how to handle financial differences with a sibling, “When one sibling is better off than the others, it is common for others to feel entitled to the former’s wealth. When financial differences are a given, it is critical to recognize that the better-off sibling has the power to decide how, how much, and when he is willing to share his wealth. Any greed, desire or entitlement is most likely to sour the relationship, even if both parties take time to find out when things go wrong,” the article explains.

Just because one sibling has more doesn’t mean they owe the others. Open, honest conversations about expectations and limits can help maintain a good relationship with family. The goal is to support each other without allowing money to become a force that divides the family.

John’s story is the perfect example of how money can cause tensions even in the closest of families. While his decision to not lend his sister-in-law money might seem harsh, it’s coming from a sense of fairness. Just because he has more money than the rest of the siblings doesn’t mean that he is responsible for their financial well-being. After all, they are all adults.

When faced with repeated requests for money from a family member, it’s important to establish clear limits. As experts explain, setting financial boundaries with family members is necessary for maintaining healthy relationships. The first step is to identify those who frequently ask for financial help. If you notice a pattern, it’s a sign that the relationship has become unhealthy.

“It’s one thing to help a family member or friend out of a single event or crisis situation, but if you’re constantly being asked for money or loans, you’re likely caught up in an unhealthy financial relationship. You may simply feel getting taken advantage by these friends and family members who have come to rely on you as the ‘dependable’ place where they can turn,” experts explain.

After identifying the pattern, communicate your boundaries clearly and assertively. Explain that you can no longer provide financial support and suggest alternative solutions. Remember, it’s okay to say no without feeling guilty.

What do you think of family drama? Should John have agreed to help out his sister-in-law with the tax money? Drop your thoughts in the comments below.

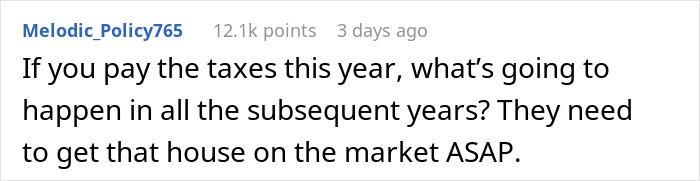

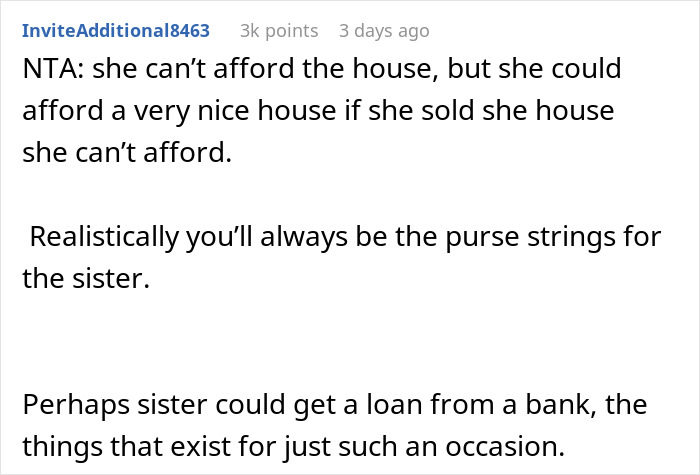

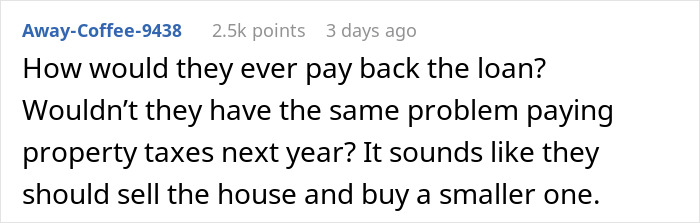

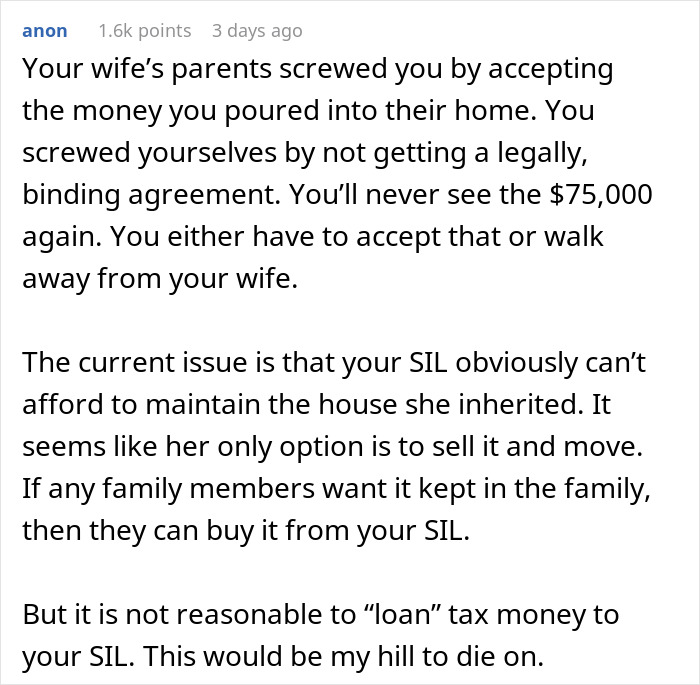

People in the comments side with the man, saying he is not a jerk for refusing to lend his sister-in-law money, saying that he will probably not see that money again

The post SIL Inherits House That Man Put His Money Into, Drama Ensues After He Refuses To Pay Her Taxes first appeared on Bored Panda.

from Bored Panda https://ift.tt/WMgGKHt

via IFTTT source site : boredpanda