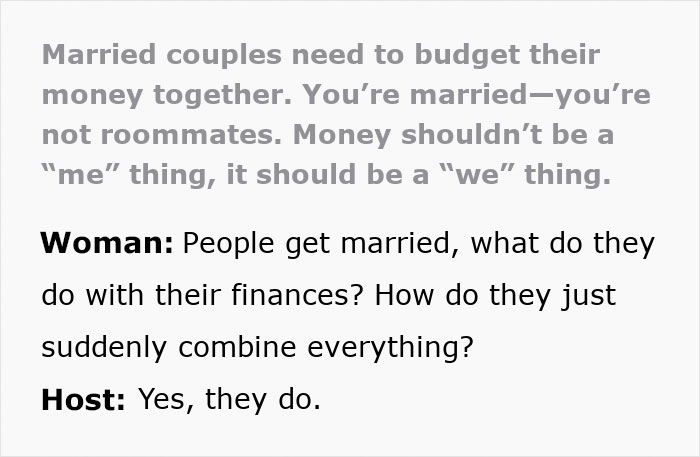

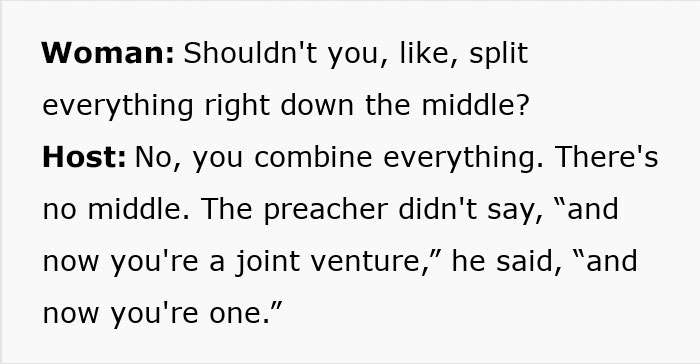

Should married couples merge their incomes and have one joint account? Financial expert Dave Ramsey seems to think so. But it’s a controversial topic, and not everyone agrees. In a TikTok video that’s since garnered thousands of views, Ramsey says money shouldn’t be a ‘me’ thing, it should be a ‘we’ thing. The expert says that sharing equally can only lead to a stronger, healthier marriage that is built on trust, teamwork, and accountability.

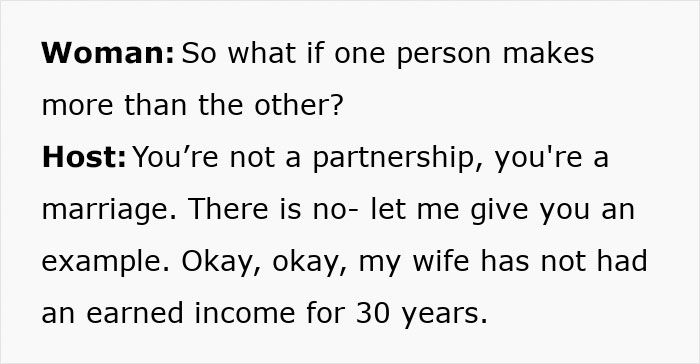

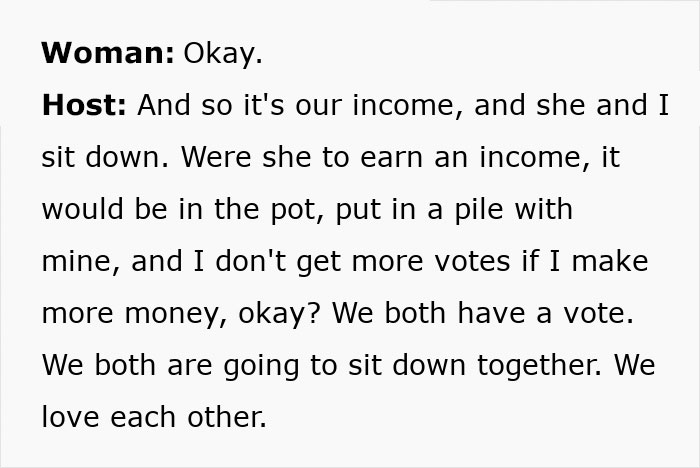

The guru was responding to a woman who wanted to know whether money should be shared equally even if one spouse earns more than the other. “You’re married. You’re not roommates!” Ramsey replied. And while some people welcomed his words, others were quick to point out that this kind of financial advice can backfire.

Dave Ramsey is a well-known financial guru who has become a go-to when it comes to money advice

Image credits: daveramsey

But not everyone agrees with him when it comes to how married couples should manage their finances

Image credits: Getty Images (not the actual photo)

Image credits: Alexander Mils (not the actual photo)

Image credits: daveramsey

“We can’t keep each area of our marriage neatly separated”: Dave Ramsey explains

Dave Ramsey is a self-made millionaire. He had a net worth of over one million by the age of 26 but soon got trapped by debt and lost everything. After clawing his way out, he made a point to teach others how to manage money responsibly and flourish.

His podcast, The Dave Ramsey Show, attracts millions of listeners every week. Many people trust him and go to him for advice. Just like the woman who wanted to know how married couples should navigate their finances after they tie the knot.

“Keeping separate accounts creates financial secrets and division,” wrote Ramsey in a separate Facebook post. “When you combine your income, goals, and expenses, you’re building trust, teamwork, and accountability—essential for a successful marriage.”

The financial guru says money touches everything. And if there are arguments about finances, the tension can spill over into areas like trust, parenting, or intimacy.

Another expert, Lindsay Bryan-Podvin, agrees. The financial therapist and author of The Financial Anxiety Solution believes that merging money decreases the likelihood of financial infidelity. Research has shown that finances are a common cause of arguments for couples. And Bryan-Podvin says this often happens when each spouse has completely separate accounts.

“Maybe somebody is racking up a ton of credit card debt or taking out personal loans. Or maybe they don’t have a great credit score and aren’t working on improving it,” Bryan-Podvin told NPR. She says when couples have a joint bank account, these issues are out in the open from the beginning.

But while Ramsey believes in the “what’s mine is yours, what’s yours is mine” strategy, Bryan-Podvin says some financial independence is important. She suggests a “theirs, mine, and ours” approach.

This means there’s a joint account where the bulk of your money is shared. It’ll be used to make sure that bills, rent, mortgage, vehicles, etc. are paid on time. Additionally, the couple can save toward future goals together.

But each spouse also has their own separate account with a bit of money for small purchases. For example, a pair of jeans. “None of us want to feel like we are under the control of our partner, so having some financial autonomy is important,” explains Bryan-Podvin.

Ramsey says he’s heard time and again that couples who combine accounts and work together experience fewer fights about money, achieve their goals faster and have stronger relationships. And this has been proven by at least one study.

A few years ago, the American Psychological Association (APA) explored whether the way in which couples keep their money affects happiness in their relationship. Upon releasing their research results in 2022, APA revealed that “couples who pool all of their money (compared to couples who keep all or some of their money separate) experience greater relationship satisfaction and are less likely to break up.”

“No man will take MY house, MY money, MY car”: not everyone welcomed Ramsey’s advice

The post People Are Divided After Finance Expert Says Married Couples Must Combine Their Incomes first appeared on Bored Panda.

from Bored Panda https://ift.tt/WutRI9G

via IFTTT source site : boredpanda