It’s a known fact that raising kids is expensive—$310,605 on average for a medium-income family to raise a baby to the age of 17 years. That’s according to Investopedia. It’s not surprising then that one of the benefits of being child-free is that you have ‘extra’ money. And you can choose where, how, or even if, you want to spend it.

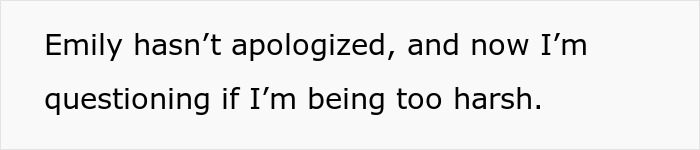

One 45-year-old woman decided that she wanted to contribute to her niece’s college fund. At least that was the case until the teen publicly humiliated her with a badly-placed child-free joke at her high school graduation ceremony. The aunt feels the level of disrespect was enough to make her rethink the college fund offer. But some feel she’s overreacting. Bored Panda spoke to two experts to get financial advice for child-free people. One is WalletHub‘s Financial Writer and Analyst Chip Lupo. The other is Estate Planning Attorney Craig Parker, who is also the Assistant General Counsel at Trust & Will.

Being child-free comes with all sorts of benefits, including more time and money to yourself

Image credits: prostock-studio / Freepik (not the actual photo)

When one teen mocked her generous aunt’s “extra money,” she wasn’t expecting to pay a hefty price

Image credits: Ecaterina MD / Unsplash (not the actual photo)

Image credits: Imaginary-Carrot2532

What should child-free people do with all that “extra money”? Financial experts advise…

Being child-free breaks the traditional models of financial planning. So says Jay Zigmont, a certified financial planner and author of “Portraits of Childfree Wealth.” According to Zigmont, the normal rules of personal finance don’t apply to people who don’t have kids.

The expert explains that traditional models of financial planning teach us to keep “running it up” so we can build a big nest egg and pass along our generational wealth to our children. But when there are no offspring, child-free people are free to spend or donate every dime they make before they die in order to maximize their happiness, he says.

“Being child-free gives you more flexibility with your finances, but it also means you need to be better prepared for when you grow older, since you may not have anyone to rely on later in life,” WalletHub‘s Financial Writer and Analyst Chip Lupo told Bored Panda during an interview. “So, always make the maximum contributions to your retirement accounts, and consider investing in products such as long-term care insurance as you age.”

Zigmont believes that if you take all your money to your grave, or leave a massive inheritance to other people, you’re doing something wrong. “If my nephews get $1,000 or $10,000 [when I die] that’s fine. If they get $1 million, I made a mistake,” Zigmont said. “Because either they could have used it earlier in life, or I could have used it.”

“It’s true that not having kids can change your financial priorities, but that doesn’t mean you should aim to spend every penny before you die,” Lupo argues. “Even if you’re not focused on leaving an inheritance, it’s still important to plan for the unexpected, which includes things like rising health care costs and a longer lifespan.”

“Having a financial cushion gives you more freedom and less stress,” adds Lupo. “And if you do end up with money left over, you can live out your final years in luxury or leave a legacy in other ways, such as supporting your favorite causes or helping extended family and friends.”

How saving differs for child-free people… the financial experts explain

Zigmont says everyone should aim to build a solid financial foundation—whether they have children or not. This means creating a starter emergency fund, getting out of debt, and building a 3- to 6-month emergency fund. Once this is locked down, child-free people and parents can follow completely different paths.

While many parents will be thinking of saving for their children’s education, or buying a house, child-free people have more freedom when it comes to how they spend or invest their money.

The expert says that while a house is a choice for childfree people, it’s not a requirement. Especially if they want more freedom to move around, travel, or are intrigued by the Nomad life. Not buying a house means your money can go elsewhere. It comes down to what do you want your goals to be, says Zigmont.

“If your goal is to open a business, maybe you want to invest in that business, where the better answer financially might be to invest in the stock market,” Zigmont advises. “Maybe it’s investing in going back to school or changing careers or taking a sabbatical. Those are all investments. They’re just not ‘classic’ investments.”

And Lupo agrees. “Being child-free gives you a unique opportunity to plan your finances around your personal goals. You could invest more of your income early on and prioritize experiences like travel or support causes that matter to you,” he told us. “It’s also smart to invest in your health and build a strong retirement plan, since you may not have a family to rely on later in life. Ultimately, the best use of your money is whatever brings you long-term peace of mind and financial stability.”

Zigmont lives by a ‘die with zero’ mantra, but admits it can be risky. After all, we don’t know when death will beckon, and we may live longer that we expect and run out of money. This is why he says it pays to invest in a long-term care policy and have lots of cash set aside. “Then it’s a matter of optimizing your life and getting the most out of your money while you’re living,” he explains.

Before you go out and blow your last dime, Zigmont warns that he does not encourage a reckless spending spree. Rather, he says, child-free people should focus on how their money can maximize their happiness.

“I’d be very careful with a YOLO approach,” said the expert. “It’s a balance between, you’ve got enough money to keep yourself safe. But you’re also enjoying your life at the same time at a much earlier age.”

An attorney unpacks estate planning for child-free people

“Without children as heirs, many child-free people choose to focus on lifestyle, impact, and legacy. That might mean investing in causes they care about, supporting friends and extended family, or giving back to their community,” says Craig Parker, Assistant General Counsel at Trust & Will. Parker is a an estate planning attorney with over 25 years of experience and kindly agreed to offer advice to our Bored Panda readers.

Parkers stressed that for individuals without children, estate planning is just as important—if not more—because there’s often no “default heir” or next of kin who can easily step in. “Without a Will, the state decides who gets your assets—and that process often doesn’t reflect your wishes,” warned Parker. “In the absence of direct heirs, your estate might go to distant relatives you barely know or trigger long delays in probate.”

The attorney says having a Will means you control who receives what, you choose who manages your affairs, you protect your values, privacy, and intent. “It’s not about the size of your estate—it’s about having a say in what happens to everything you’ve built,” he explained.

So what advice does he have for child-free people when it comes to planning their Will?

“Name a trusted executor or trustee who understands your values and can carry out your wishes,” he told us. “Choose your beneficiaries intentionally—this could be family members, friends, nonprofits, or even your alma mater.” Parker added that it’s also important to designate agents for medical and financial Power of Attorney, so that someone you trust can advocate for you if you’re incapacitated.

“Create a Living Will or Advance Directive to clearly state your healthcare preferences,” added the expert. “Don’t forget digital assets—including your social media, photo libraries, and online accounts. Include access instructions and outline your wishes.”

Parker says some child-free people may choose to fund scholarships or research through charitable foundations. Others might support animal rescue organizations, environmental groups, or cultural institutions. Then there are those who decide to leave assets to longtime caregivers, close friends, or those who provided support later in life.

“The beauty of being child-free is having the freedom to define your own version of legacy,” Parker told Bored Panda.

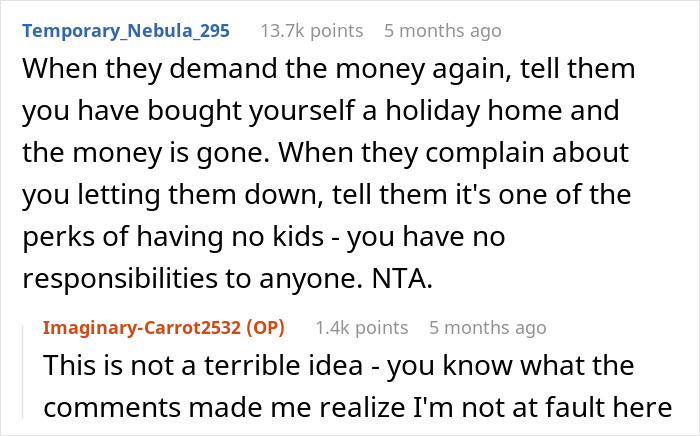

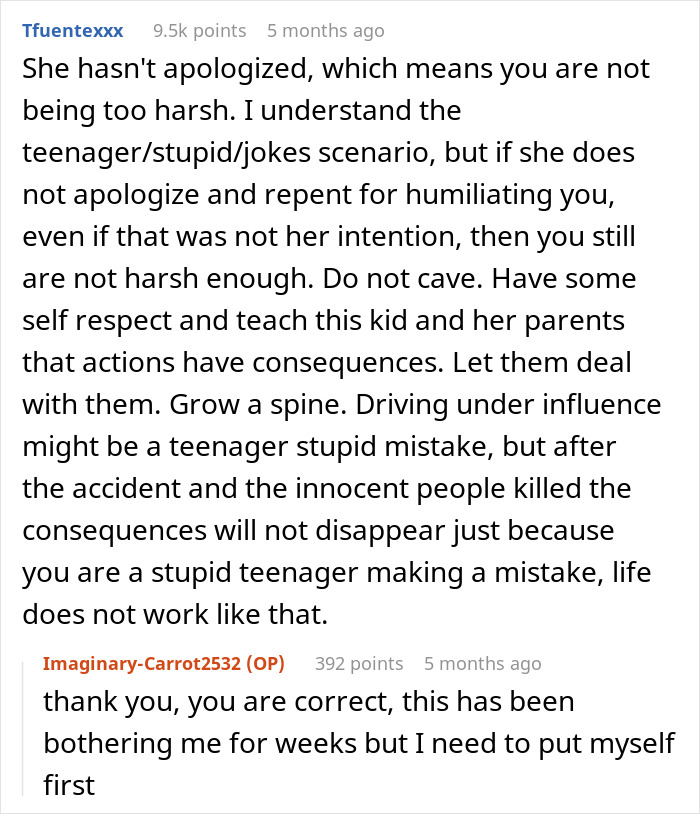

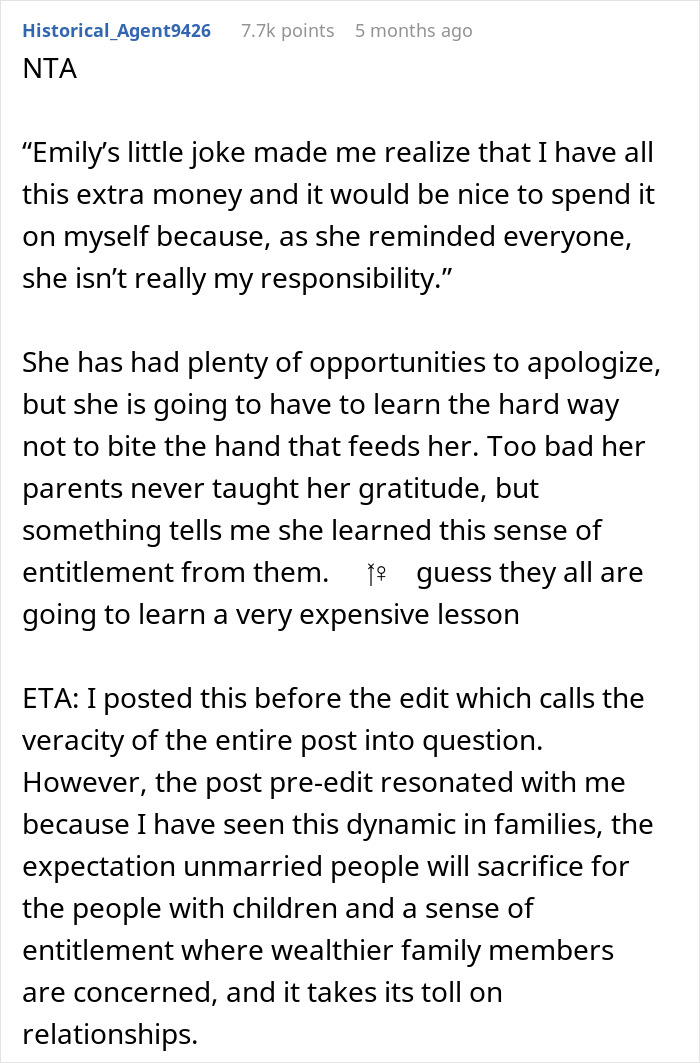

Many people felt the aunt was justified, and some even offered advice on how she should spend the money

Netizens called out the aunt for throwing a “temper tantrum”

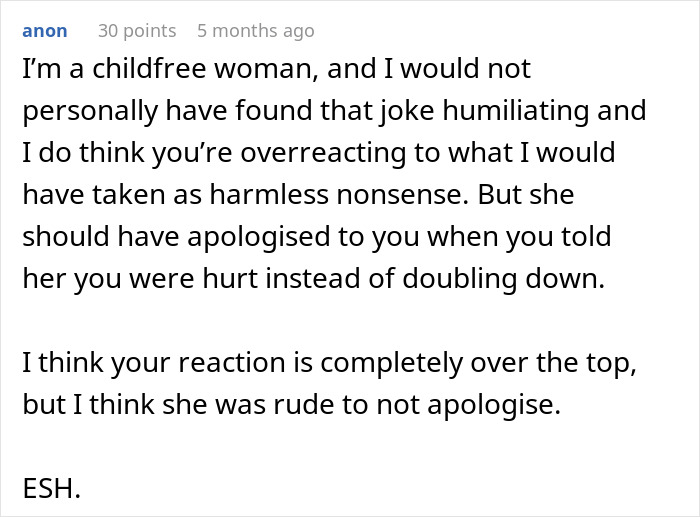

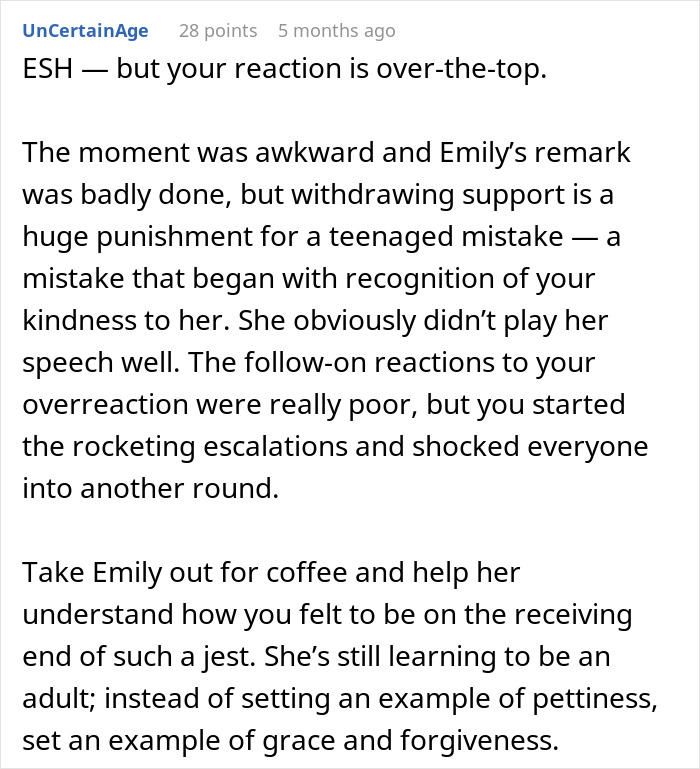

Some felt that both the aunt and niece were wrong

from Bored Panda https://ift.tt/HXw1d3x

via IFTTT source site : boredpanda